Scammers are always active online - and many of us already have a level of caution when it comes to email safety and sharing information digitally. Re

Scammers are always active online – and many of us already have a level of caution when it comes to email safety and sharing information digitally. Regardless, no-one really could have predicted the arrival of the COVID-19 crisis this year, let alone the enormous surge in online crimes that it has brought with it. Caution online is arguably more important than ever before.

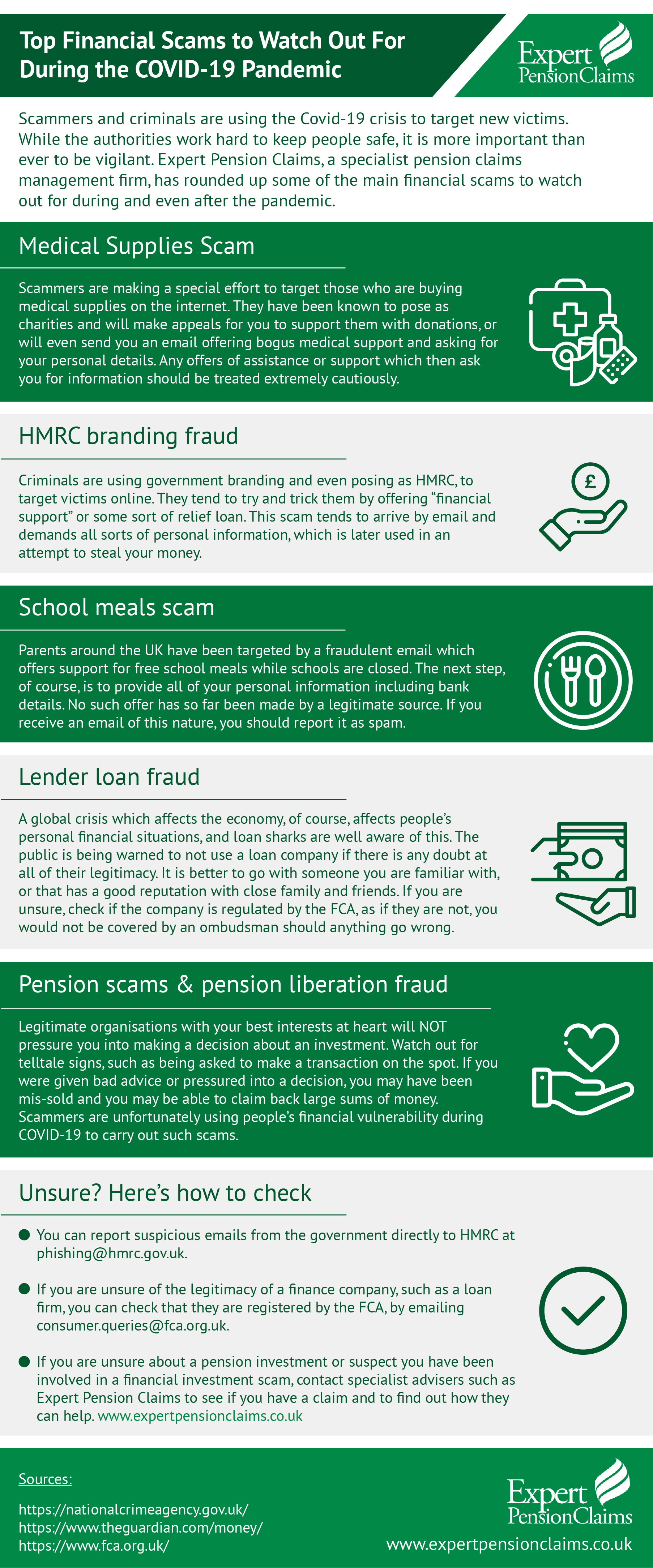

A pandemic or crisis of this sort is, perhaps not surprisingly, a window of opportunity for scammers who are looking to target new victims. Not only can they appeal directly to your needs by offering you money or medical supplies, they are trying harder than ever to mimic legitimate organisations, using their logos and brand names without shame.

As the pandemic has grown, so have these specific scams, with the National Cyber Security Centre even closing down hundreds of scam Covid-19 shops which were selling fake medical items.

The mis-sold pension advisors and claims management team at Expert Pension Claims has rounded up some of the most common financial scams that are circulating amid the COVID-19 crisis, with tips on what to do if you think you have been targeted. Take a look…

Be particularly vigilant with scam emails

In this day and age it’s probably not surprising to hear that the most common type of scam is online, and the most common mode of communication is email. It has been reported how Google is blocking around 18M scam emails on a daily basis, which is 126M every week. This sharp incline in phishing attacks has happened for one simple reason – that scammers prey on vulnerability and crisis.

Here are some top tips for exercising caution online:

- Never open emails from people you don’t know.

- Watch out for subject lines offering money or something for free. If it seems too good to be true, it likely is.

- If you do open an email, never click a link or open a file if you don’t know where it’s from.

- Keep your password safe, and change it every few months if possible.

- Remember never to share your personal information online unless it’s a site you’re familiar with, like your own bank.

Pension scams & protecting your retirement fund

There’s one particular avenue that scammers will go down when targeting new victims, and that’s pensions. Sadly, this is a perfect example of how such criminals deliberately target those they deem more vulnerable, and less aware of the dangers online.

You may be contacted and asked to move large amounts of cash to a “safer place”, or you will be asked for very personal information about your pension product. Remember that scammers are opportunists and their goal is to trick you into trusting them – no matter how legitimate the email might appear to you, you should stay completely on your guard.

It was recently reported how pension scams have risen as a result of COVID-19 – with some fraudsters even claiming to be pension providers or insurers. Out of the blue offers of high investment returns could be one major sign of a scam.

Pension mis-selling and SIPP claims

Pension mis-selling is another type of pension scam which is not specific to the COVID-19 crisis, but is certainly still taking place. In a nutshell, to be mis-sold is to be given poor advice, ultimately leading to you losing money. Top signs of pension mis-selling are:

- A seller has given you unsuitable advice on moving money around

- You were not given an outline of the risks before investing money

- You felt pressured into a decision before you had chance to learn all of the facts

If you think you may have been mis-sold a pension or given bad pension advice, you’re one of a large number of people in the UK who are due a payout.

Get in touch with Expert Pension Claims today to talk through your options – they’ll be able to tell you there and then if you have a potential claim.

COMMENTS